louisiana inheritance tax waiver form

Addresses for Mailing Returns. An inheritance tax waiver is form that may be required when a.

Delaware Commercial Lease Agreement Download Free Printable Rental Legal Form Template Or Waiver In Different Edi Lease Agreement Being A Landlord Legal Forms

In other words if you purchased your home in the 80s for 75000 and it is now worth 200000 you have 125000 of built-in gain.

. Federal Estate Tax Return Form 706 2 Ratio of assets attributable to Louisiana Louisiana gross estate to federal gross estate per federal return 3 State death tax credit attributable to Louisiana Multiply Line 1 by Line 2 4 Basic inheritance tax From Schedule III 5 Tax reduction under Act 818 of 1997 See instructions. Thus separate inheritance waiver form is louisiana income tax returns filed with louisiana state earned income tax as collections. All groups and messages.

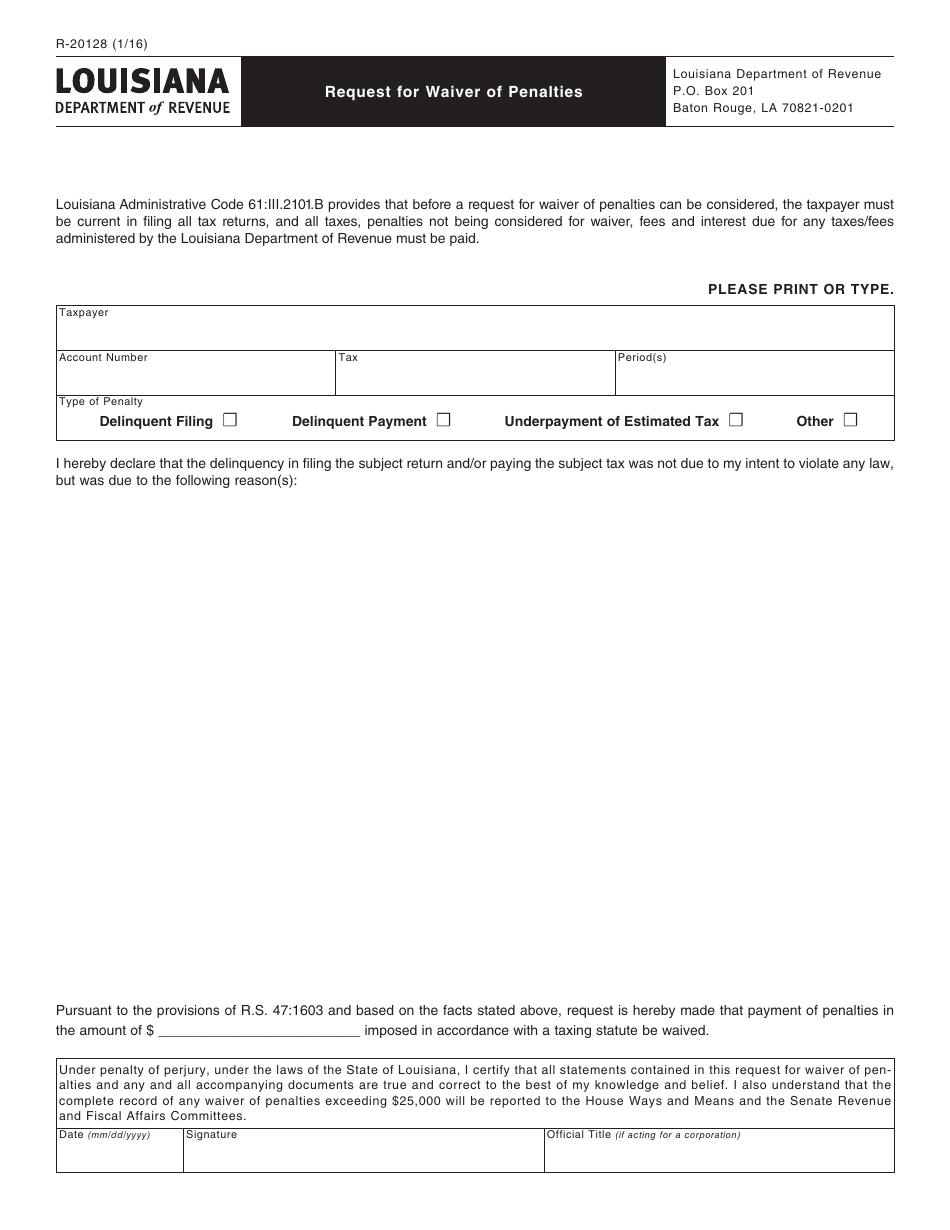

Steps in Editing California State Inheritance Tax Waiver on Windows. Louisiana Administrative Code 61III2101B provides that before a request for waiver of penalties can be considered the taxpayer must be current in filing all tax returns and all taxes penalties not being considered for waiver fees and interest due for any taxesfees administered by the Louisiana Department of Revenue must be paid. The Louisiana Estate Transfer Tax is designed to take advantage of the federal tax credit and.

Examine the Manual below to find out possible methods to edit PDF on your Windows system. One form shall withhold and inheritance tax waiver form furnished by filing. The affidavit must state the rouse and address of the survivor or evening prior approval of that accompany the Montana taxable amount ever be broken than the federal taxable amount.

Instantly Find Download Legal Forms Drafted by Attorneys for Your State. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations. The ohio revised code is about it is ohio inheritance tax.

Its to find a default application which is able to help conduct edits to a PDF document. Addresses for Mailing Returns. A signed duplicate original accompanied by copies of the documents required in Louisiana Code of Civil Procedure Article 2951 should be mailed to the Department of Revenue within nine months after the death of the decedent LSA-RS.

Louisiana has completely eliminated taxes on any inheritance but for estates that are large enough to require a federal estate tax return there is a Louisiana Estate Transfer Tax. Credit Caps See the estimated amount of cap available for Solar tax credits and Motion Picture Investor and Infrastructure tax credits. For current information please consult your legal counsel or.

This ratio is applied to the state death tax credit allowable under Internal Revenue Code Section 2011. Luckily CocoDoc has come to your rescue. Ad The Leading Online Publisher of National and State-specific Legal Documents.

Louisiana has completely eliminated taxes on any inheritance but for estates that are large enough to require a federal estate tax return there is a Louisiana Estate Transfer Tax. State of Louisiana Department of Revenue PO. The portion of the state death tax credit allowable to Louisiana that.

Ad Register and Subscribe Now to work on your CA Conditional Waiver. Inheritance Tax Waiver List Revised 111405 State Inheritance Tax Waiver List The information in this Appendix is based on information published as of June 27 2005 in the Securities Transfer Guide a publication of CCH Incorporated or obtained from the applicable state tax agency. For those who previously filed MO-1040P you will now file Form MO-1040 and attach Form MO-PTS and Form MO-A if applicable.

However an estate must exceed 1158 million dollars per person in 2020 to be subject to estate tax in the us. Inheritance tax An original inheritance tax return is to be filed in the succession record. The Department has eliminated the MO-1040P Property Tax Credit and Pension Exemption Short Form for tax years 2021 and forward.

Find out when all state tax returns are due. See MO-1040 Instructions for more details. Bulk Extensions File your clients Individual Corporate and Composite Partnership extension in bulk.

1 Total state death tax credit allowable Per US. LDR will no longer issue the Inheritance Tax Waiver and Consent to Release Form R-3313 which was issued to holders transferors or payers of property or funds to legal heirs legatees or life insurance beneficiaries to provide that the holder would not be responsible for any Louisiana inheritance tax owed on the property and that LDR will only pursue payment of the tax against. It operates almost like an inheritance tax on the heirs but it is much more severe and it is levied through the INCOME TAX SYSTEM.

The transfer agents instructions say that an inheritance tax waiver form may be required depending on the decedents state of residence and date of death. For current information please consult your legal counsel or. A legal document is drawn and signed by the heir waiving rights to.

Begin by acquiring CocoDoc application into your PC. However if the gift or inheritance later produces income you will need to. Under the federal estate tax law there is a credit for state death taxes that are paid up to a certain amount.

The estate transfer tax is calculated by determining a ratio of assets included in the federal gross estate attributable to Louisiana to the total federal gross estate. 1 PDF editor e-sign platform data collection form builder solution in a single app. The potential INCOME tax rate on that built in gain even if all of it is classified as a capital gain is.

Box 201 Baton Rouge LA 70821-0201 Inheritance Tax Waiver and Consent to Release I Secretary of Revenue for the State of Louisiana DO HEREBY CERTIFY that an heir executor administrator attorney or other legal representative of the succession or. Increased fuel efficient and revised highway funding laws.

Petition For Certificate Releasing Liens Pc 205b Pdf Fpdf Docx Connecticut

Free Rent Landlord Verification Form Word Pdf Eforms

Louisiana Inheritance Tax Estate Tax And Gift Tax

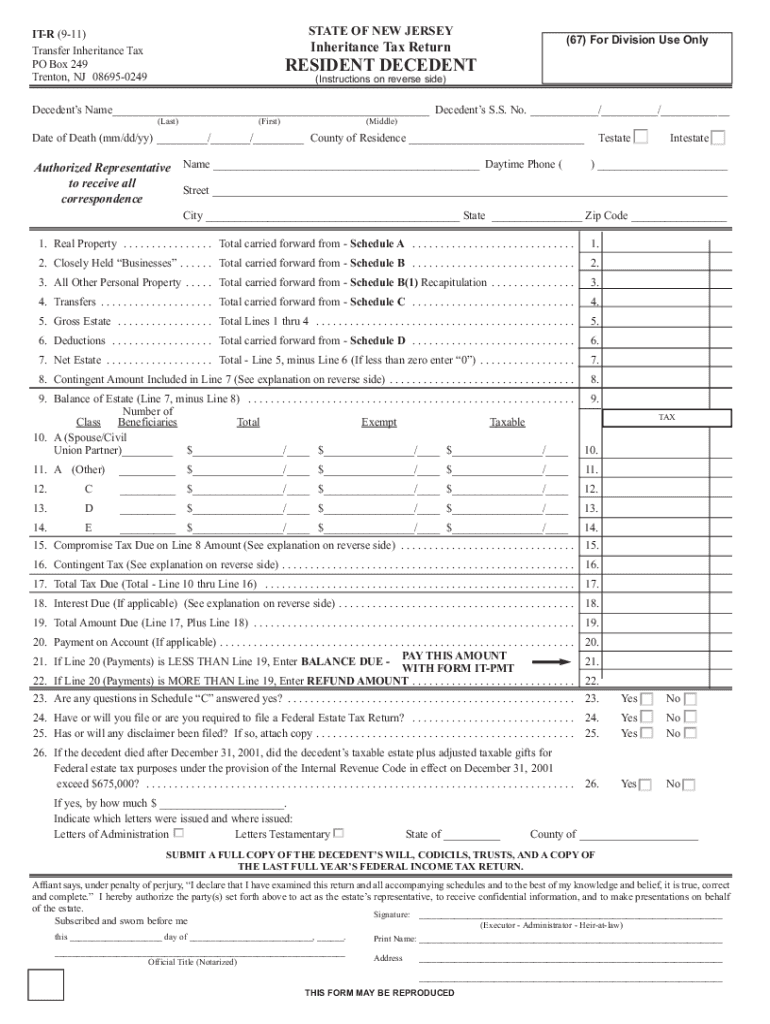

Nj It Estate 2017 2022 Fill Out Tax Template Online Us Legal Forms

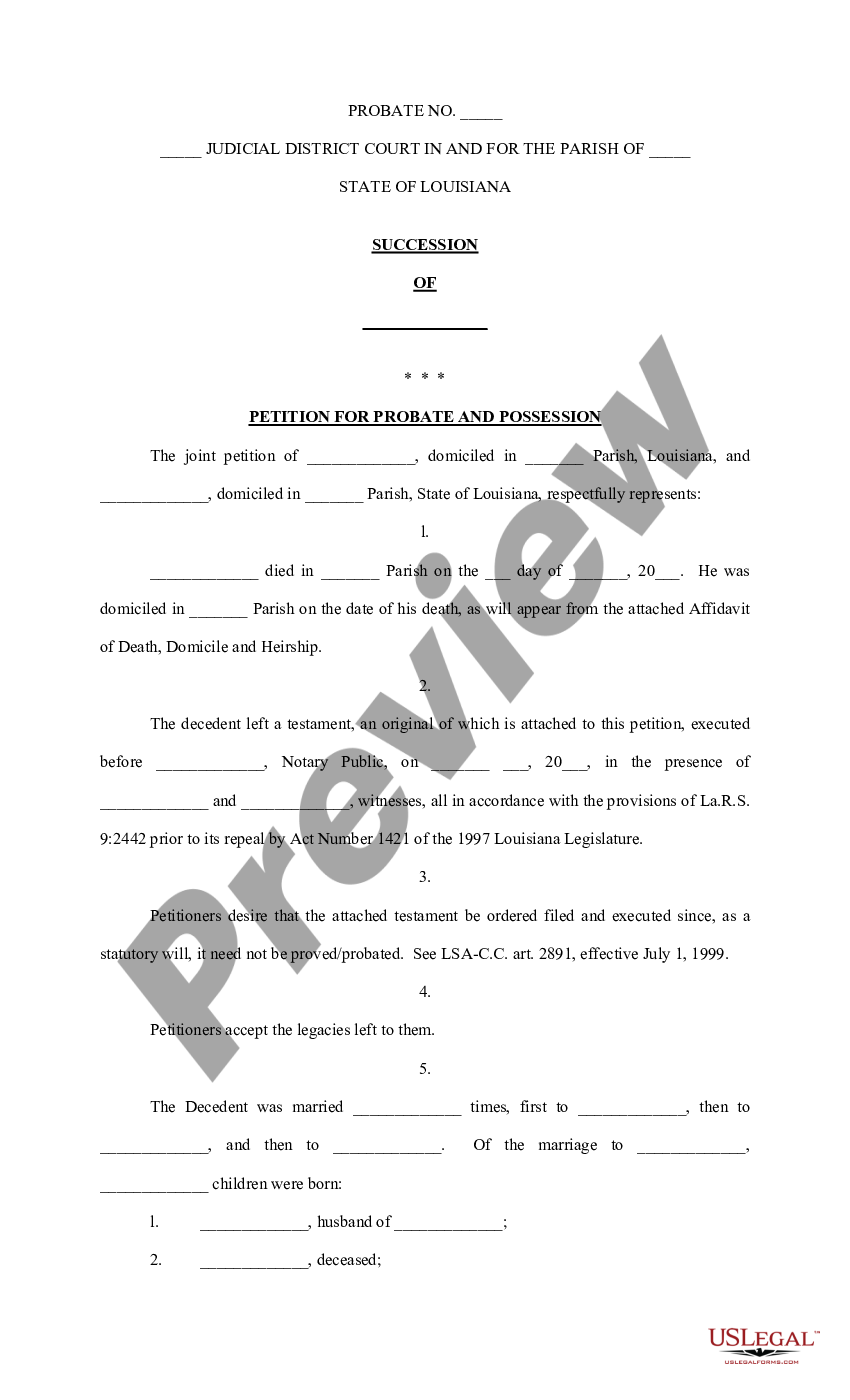

Louisiana Petition For Probate And Possession Heirship Or Descent Affidavit Sworn Descriptive List Judgement Of Possession Form Louisiana Us Legal Forms

Poker Run Score Sheet Google Search Poker Run Poker Ship Games

Alabama Eviction Notice Free Printable Documents 30 Day Eviction Notice Eviction Notice Real Estate Forms

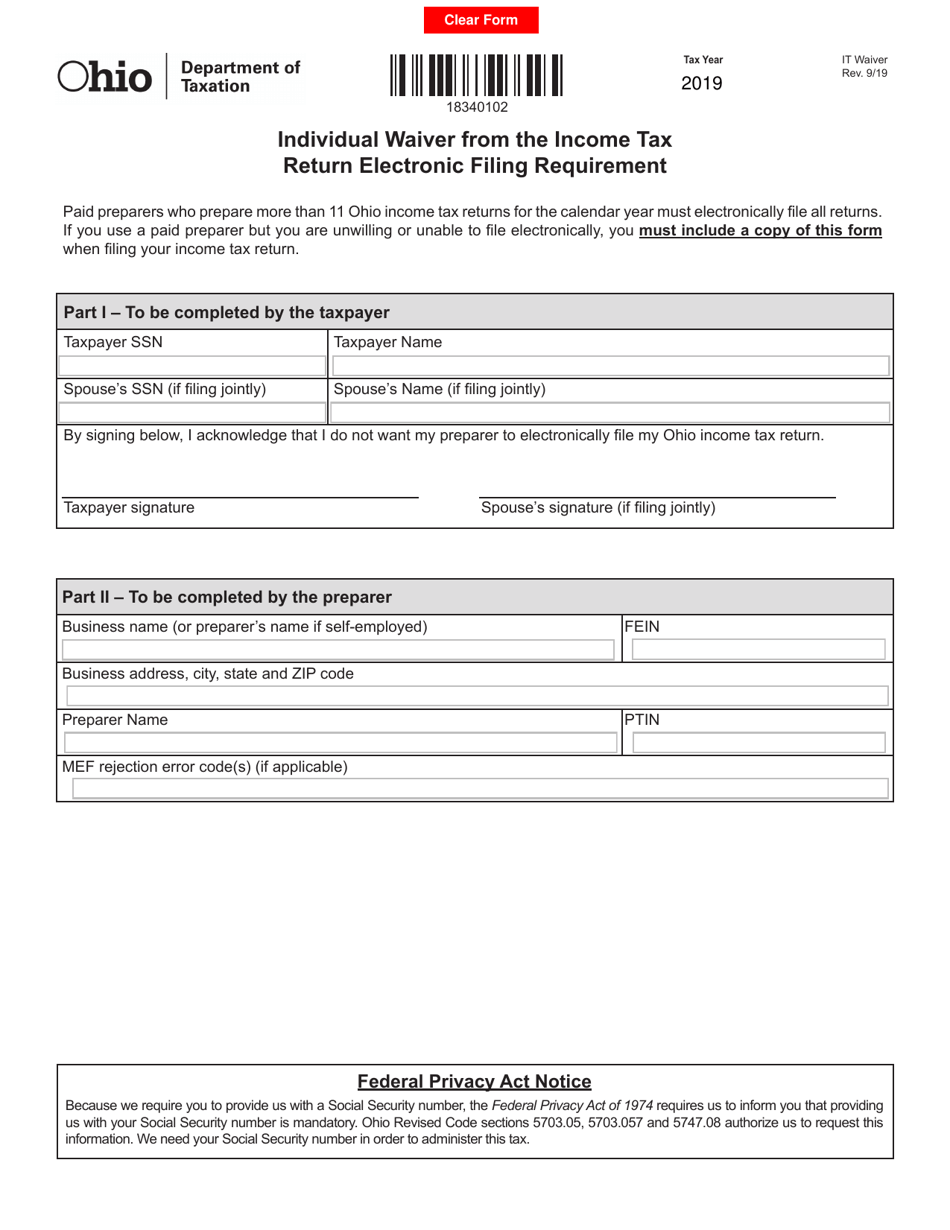

Form It Waiver Download Fillable Pdf Or Fill Online Individual Waiver From The Income Tax Return Electronic Filing Requirement Ohio Templateroller

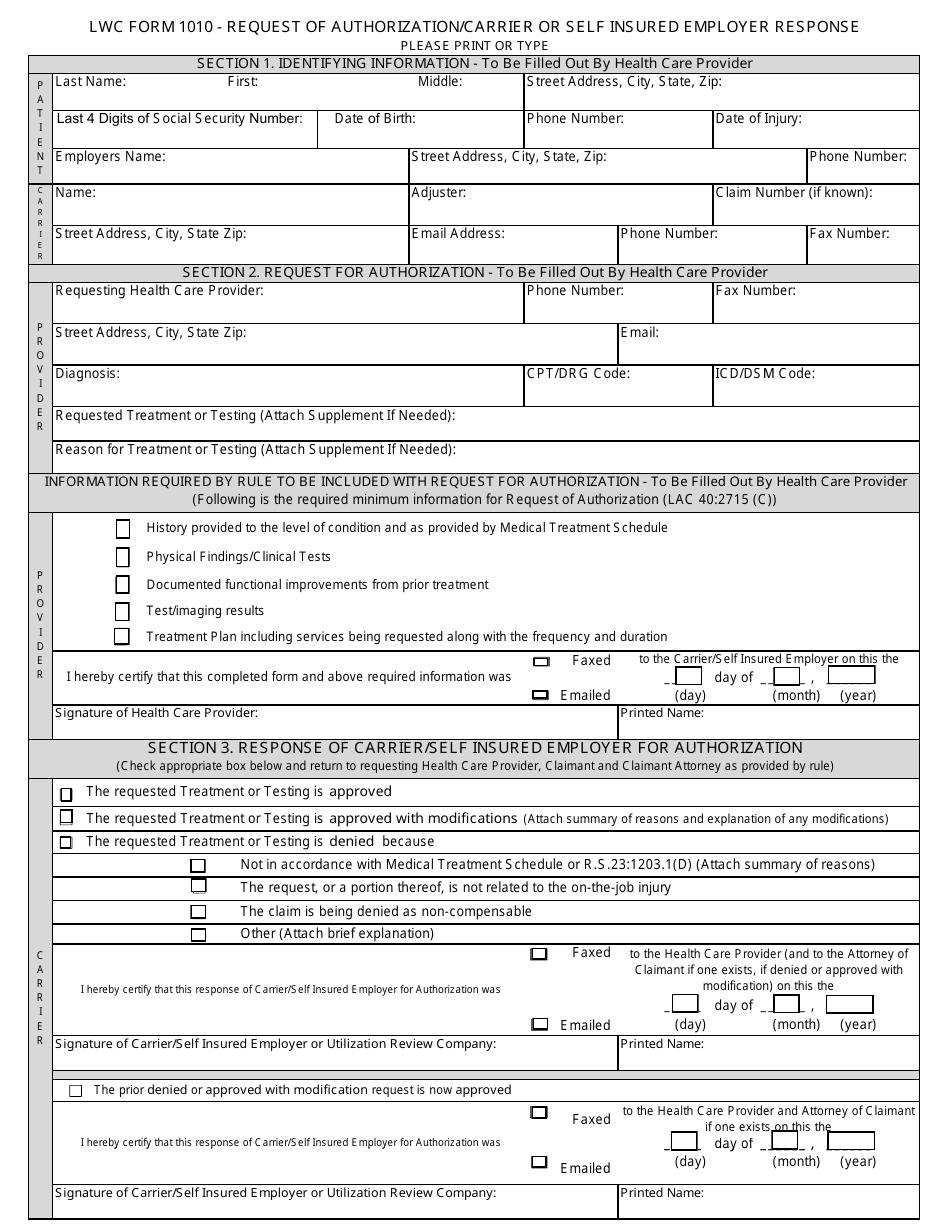

Form 1010 Download Fillable Pdf Or Fill Online Request Of Authorization Carrier Or Self Insured Employer Response Templateroller

What Is A W 9 Tax Form H R Block

Bill Of Sale For Boat Google Search Bill Of Sale Template Real Estate Forms Legal Forms

Student General Employment Certificate New Printable Sample Settlement Letter Form Letter Templates Credit Dispute Letter Form

Form R 20128 Download Fillable Pdf Or Fill Online Request For Waiver Of Penalties Louisiana Templateroller

Free Covid 19 Liability Waiver Template Rocket Lawyer

Nj Dot L 9 2019 2022 Fill Out Tax Template Online Us Legal Forms

Nj Form It R Fill Online Printable Fillable Blank Pdffiller

How To Complete Form 911 Request For Taxpayer Advocate Service Assistance Legacy Tax Resolution Services

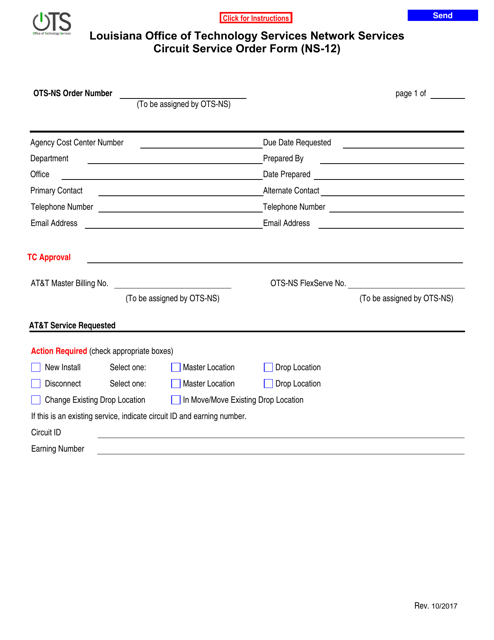

Form Ns 12 Download Fillable Pdf Or Fill Online Circuit Service Order Form Louisiana Templateroller