santa clara county property tax credit card fee

298 Garden Hill Drive. If you have any questions or need help paying online please call us for assistance 408 918-4601.

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Only credit card or intra-charge account are accepted as a form of payment via email.

. The current convenience fees are. Residents of Santa Clara County California pay on average 4694 a year in property taxes. Use the courtesy envelope provided and return the appropriate stub scoupon s with your payment to ensure timely processing.

A secure online payment system will make it convenient for property owners to pay their taxes said Cheryl Johnson Santa Clara County Tax. Application forms for Proposition 19 are required to be submitted to the Assessor in which the replacement property is located. Enter Property Parcel Number APN.

In Person Dropbox. Pay your 2nd installment by April 11th to avoid penalties and fees eCheck payment is free. A non-refundable processing fee of 110 is required in Santa Clara County.

Business Division 70 West Hedding Street First Floor East Wing San Jose CA 95110. The great news is that if you live in Santa Clara County you likely pay less in property taxes than other Californians. If paying by credit or debit card a convenience fee is charged by the payment processing company.

Department of Environmental Health 1555 Berger Drive Bldg 2 Suite 300 San Jose CA 95112. We accept payments of cash checks and credit cards Subject to transaction fee see below. Valuation Based Fee Table for Building Permit Review.

Thank you for your cooperation. Please include your invoice numbers on any checks you mail in to our office to ensure the credit is properly applied to your Environmental Health Account. But figuring out exactly how much you owe who to pay it to and what your.

Please include your invoice numbers on any checks you mail in to our office to ensure the credit is properly applied to your Environmental Health Account. Valuation Based Fee Schedule. All certified copies must contain all pages of the document.

Learn why Santa Clara County was ranked a top 40 Healthiest Community by US. Your Santa Clara property taxes are due in two installments per year. The first installment is due on Nov.

Paper property tax bills are sent too but they can take a while to make it to your mailbox. There is however a fee for paying by credit card. Notices such as these are not authorized nor sent by the County of Santa Clara Department of Tax and Collections.

Credit cards and e-checks are all accepted without any service charge to you. On Monday April 11 2022. Department of Environmental Health 1555 Berger Drive Bldg 2 Suite 300 San Jose CA 95112.

13-25 DAYS PER EVENT Risk Category 1 RC1 Low Risk 9900 9900 Risk Category 2 RC2 Moderate Risk 14500 20200 Risk Category 3 RC3 High Risk 18600 24100 Sampling Only - No foodbeverage sales. Have your Visa MasterCard or Discover card ready. If you have any questions please call 408-808-7900.

The county does provide a web portal to pay your tax bills. The Assessor has developed an on line tool to look up basic information such as assessed value and assessors parcel number APN for real property in Santa Clara County. East Wing 6th Floor.

San Jose CA 95110-1767. Please call our Parks Administrative Office at 408 355-2200 Monday - Friday 800 am. A certified copy is a true and accurate representation of the original with a statement of certification and the seal of the County Clerk-Recorder.

Senior citizens and blind or disabled persons in Santa Clara County can apply for a postponement on their property tax as long as they are at least a 40 owner of the property and. Here is the Santa Clara County Property Tax Mailing Address. The County of Santa Clara Department of Tax and Collections DTAC representatives remind property owners that the second installment of the 2021-2022 property taxes is due February 1 and becomes delinquent at 5 pm.

We accept cash check money. For Secured property only DEPARTMENT OF TAX AND COLLECTIONS PO BOX 60534 CITY OF INDUSTRY CA 91716-0534. To avoid financial penalties the second installment of the 20022003 property taxes must be paid by 500 pm Thursday April 10 2003.

Include your mailing address the Parcel Number suffix and installment number of the bill being. Department of Tax and Collections. Checks should be made out to County of Santa Clara.

Accepting MasterCard Discover Visa. Santa Clara County Parks Recreation Department. 1-12 DAYS PER EVENT.

Limited to small sample sizes 8800 8800. With an 817 billion budget more than 70 agenciesdepartments and nearly 22000 employees the county of santa clara plans for the needs of a dynamic community offers quality services and. Credit card payments for the processing fee are accepted in person at our office.

Paying online is FREE easy and contactless. PROPERTY ASSESSMENT INFORMATION SYSTEM. We do not accept credit card payments over the phone.

Visit their website and pay your real estate tax bill online. Please make checks payable to County of Santa Clara. Please be advised any notices sent by the Department of Tax and Collections will have the County Seal and the Department of Tax and Collections contact information.

The fee amount is based upon a percentage of the transaction. You can also pay your property tax bill in person but lines for in-person payments can be long particularly as the tax deadline approaches. 100 disabled veterans may be eligible for an exemption of up to 150000 off the assessed value of their property.

4 first page 2 each additional page 2 certification fee. News and World Report. This is an average tax rate of 067 which is below the state average of 074.

Santa Clara County Clerk-Recorders Office ATTN. Please make checks payable to County of Santa Clara. If you elect to pay by credit card please be aware that these fees are added to your transaction.

CreditDebit Card 225 of the taxes being paid minimum 250 convenience charge eCheck No convenience fee for the taxpayer. You will be levied a fee for credit card or debit card. Please make checks payable to County of Santa Clara.

You may obtain an Annual Pass at the Parks Administration Office located in Vasona Park at. County Clerk Processing Fee.

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Property Taxes Department Of Tax And Collections County Of Santa Clara

Solved Revenue Gross Sales Less Sales Returns And Allow Chegg Com Cost Of Goods Sold Cost Of Goods Payroll Taxes

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

3 21 3 Individual Income Tax Returns Internal Revenue Service

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Santa Clara County Ca Property Tax Calculator Smartasset

3 21 3 Individual Income Tax Returns Internal Revenue Service

Flintstones In Viva Rock Vegas Prop Bronto Crane Test Credit Card

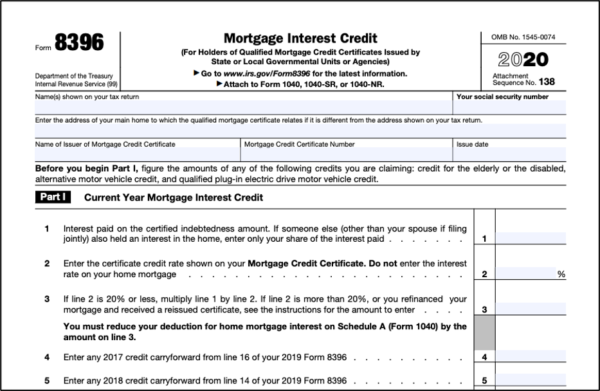

What Is A Mortgage Credit Certificate Mcc And Are They Worth It

Pay Your Property Taxes Unsecured Treasurer And Tax Collector

Residential Occupancy Permit Renewal City Of San Jose

Bay Area Home Prices Reach Record Highs But Sales Tumble House Prices Tumbling Price

3 11 13 Employment Tax Returns Internal Revenue Service

Penalty Cancellation Due To A Lost Payment Affidavit Treasurer And Tax Collector

Quickbooks Online How To Record And Process Credit Card Payments